hotel tax calculator texas

Maximum Possible Sales Tax. Only In Your State.

Call a hotel tax specialist toll-free at 800-252-1385.

. State has no general sales tax. All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache.

Texas State Sales Tax. So if the room costs 169. Use our Tax-Exempt Entity Search.

The states HOT tax as its often called has been around since 1959 when the Texas Legislature enacted a 3 percent hotel occupancy tax. Before-tax price sale tax rate and final or after-tax price. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room.

To get the hotel tax rate a percentage divide the tax per night by the cost of the room before taxes. Your household income location filing status and number of personal. Multiply the answer by 100 to get the rate.

Hotel and Short Term Rental Tax Calculator. Texas Income Tax Calculator 2021. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room.

Call a hotel tax specialist toll-free at 800-252-1385. To report and pay your taxes you must log in to your. For example the total cost of a nights stay is.

The State of Texas imposes an additional Hotel Occupancy Tax. That means that your net pay will be 45925 per year or 3827 per month. The calculator will show you the total sales tax.

Average Local State Sales Tax. Two rate hikes by lawmakers in the 1980s brought it to the present state rate of 6 percent. Hotel Tax Calculator Texas.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Read Hotel Occupancy Tax Exemptions. Maximum Local Sales Tax.

Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. Cities and certain counties and special purpose districts are authorized to impose an additional local. The calculator will show you the total sales tax amount as well as the county city and.

7 state sales tax on lodging is lowered to 50. 4 Specific sales tax levied on accommodations. This tool is provided to estimate past present or future taxes.

This is not an official tax report. Cities and certain counties and special purpose districts are authorized to impose an additional local. Texas law requires that each bill.

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. If you make 55000 a year living in the region of Texas USA you will be taxed 9076. Your average tax rate is 1198 and your marginal tax rate is 22.

If you make 70000 a year living in the region of Texas USA you will be taxed 8387. The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The City of Austins Hotel Occupancy Tax rate is 11 percent comprised of a 9 percent occupancy tax and an additional 2 percent venue project tax. And all states differ in their. And if you live in a state with an income tax but you work in Texas.

Two rate hikes by lawmakers in the 1980s brought it. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room.

Tax Information City Of Hartford

Hotel Occupancy Tax San Antonio Hotel Lodging Association

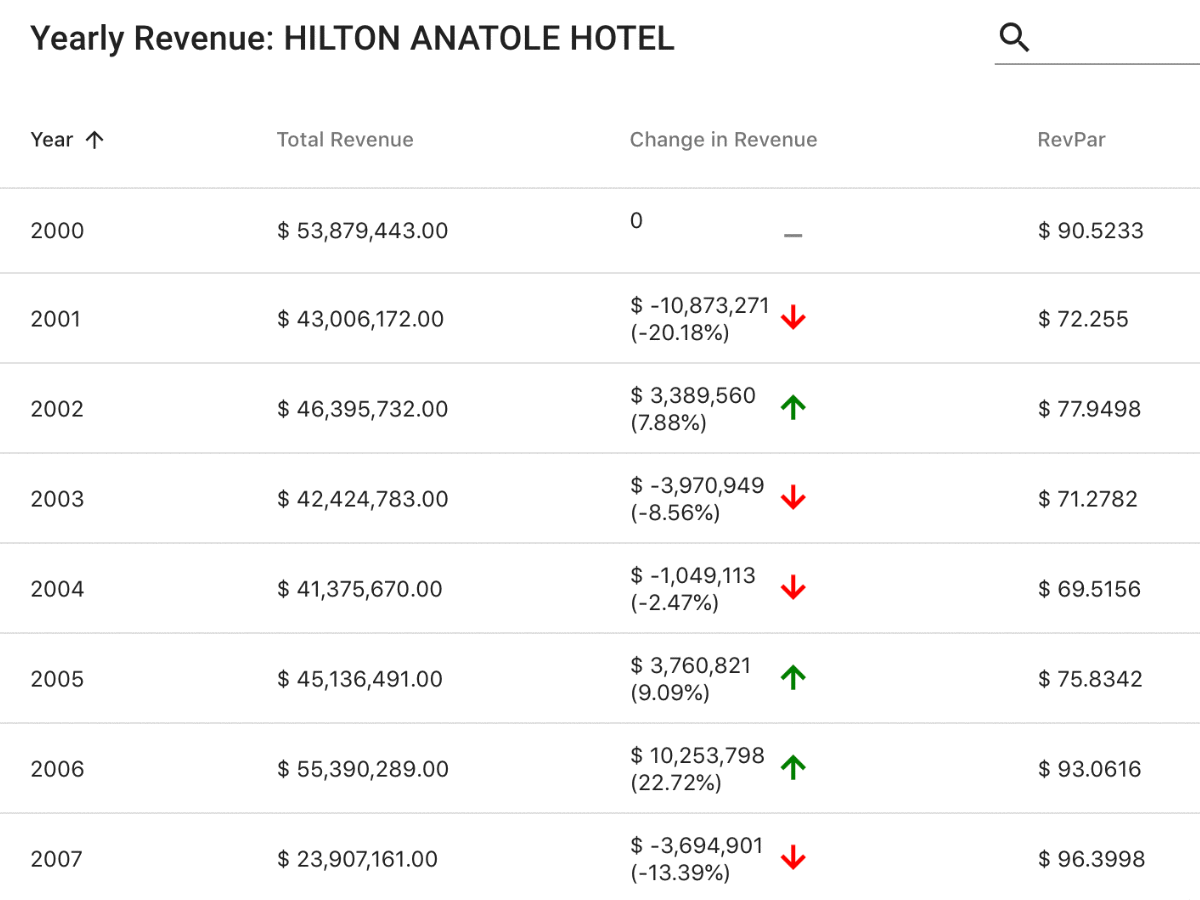

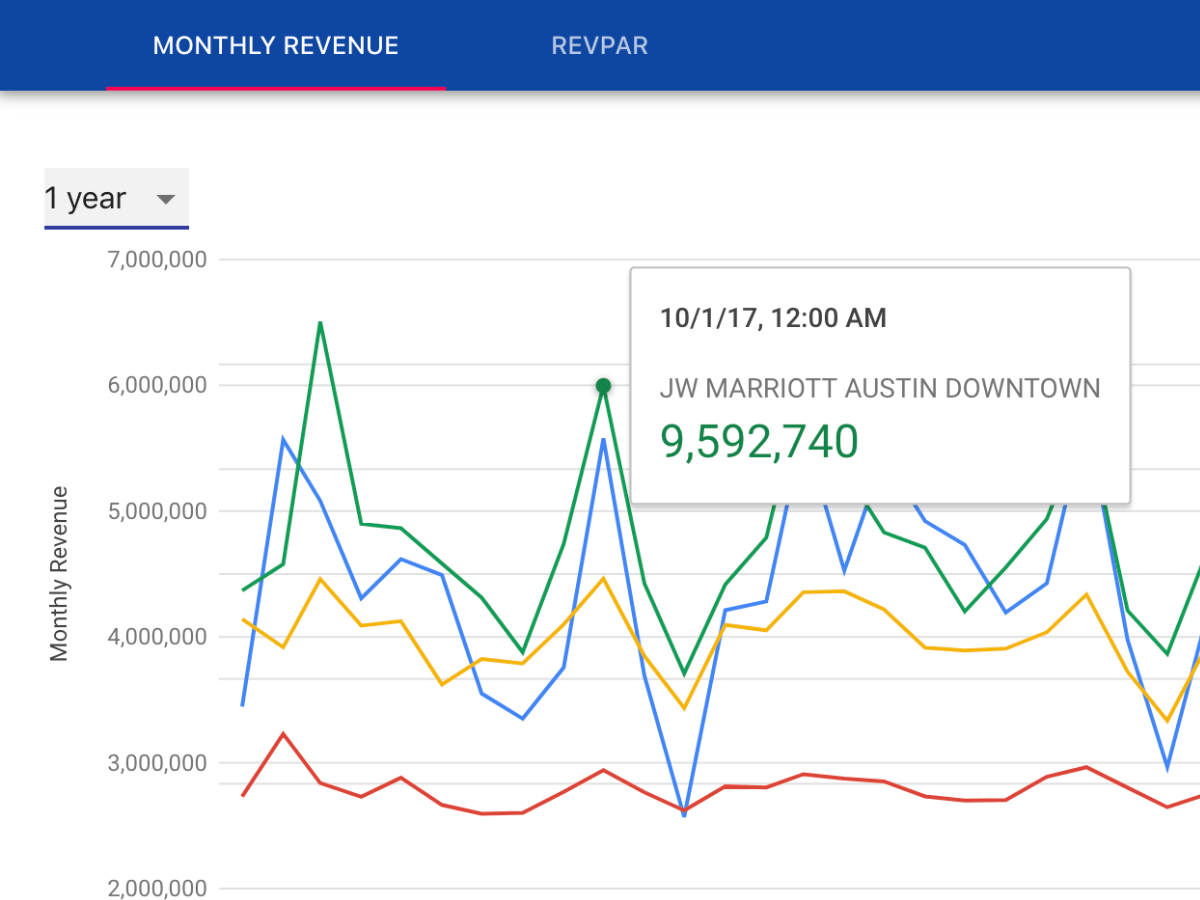

Texas Hotel Occupancy Tax Receipts And Revenue Database Search Searchtexastax Com

What Is Hotel Occupancy Tax Texas Hotel And Lodging

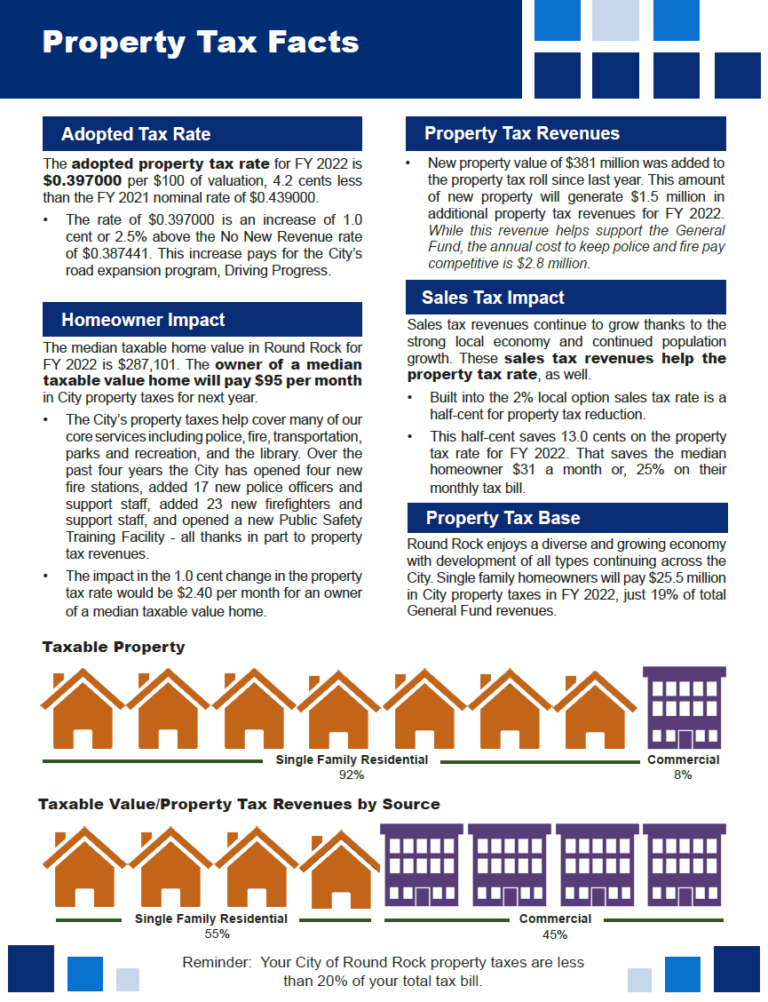

Budget Office City Of Round Rock

Occupancy Taxes On Vacation Rental Properties What You Need To Know

How To Manage Multistate Tax Planning As A Small Business Owner

Tax Information Granbury Tx Official Website

Property Tax Rates Town Of Little Elm Tx Official Website

Sales Taxes In The United States Wikipedia

Revised Travel Guidelines Procedures Finance Course Outcomes Understand Basic Travel Guidelines Per Diem Includes Demonstrate How To Complete Ppt Download

Who Pays The Transient Occupancy Tax Turbotax Tax Tips Videos

Texas Hotel Occupancy Tax Receipts And Revenue Database Search Searchtexastax Com