are 529 contributions tax deductible in oregon

Up to 300 for MFJ 150 all others. The 2021 tax year only 529 plan contributions were deductible Oregon Yes Yes Maximum credit of 150 for individuals and 300 for joint filers per year for contributions to Oregon plans.

529 Tax Benefits By State Invesco Invesco Us

For more information about 529 Contributions visit.

. For more on the changes to the oregon plan continue reading or 529 part 2 here. New Mexico Deduct any amount contributed to in-state 529 plans North Dakota Deduct up to 5000 per year Ohio Deduct up to 4000 per year for each beneficiary Oklahoma Deduct up to 10000 per year Oregon Can claim up to 150 as a tax credit for contributions Rhode Island Deduct up to 500 per year. When you invest with the Oregon College Savings Plan your account has the chance to grow and earn interest tax-free.

Deposit your Oregon personal income tax return refund into a preexisting Oregon College Savings Plan or MFS 529 Savings Plan account. A 529 plan allows you to save for college or higher education while receiving some type of tax benefit. The contributions made to the 529 plan however are not deductible.

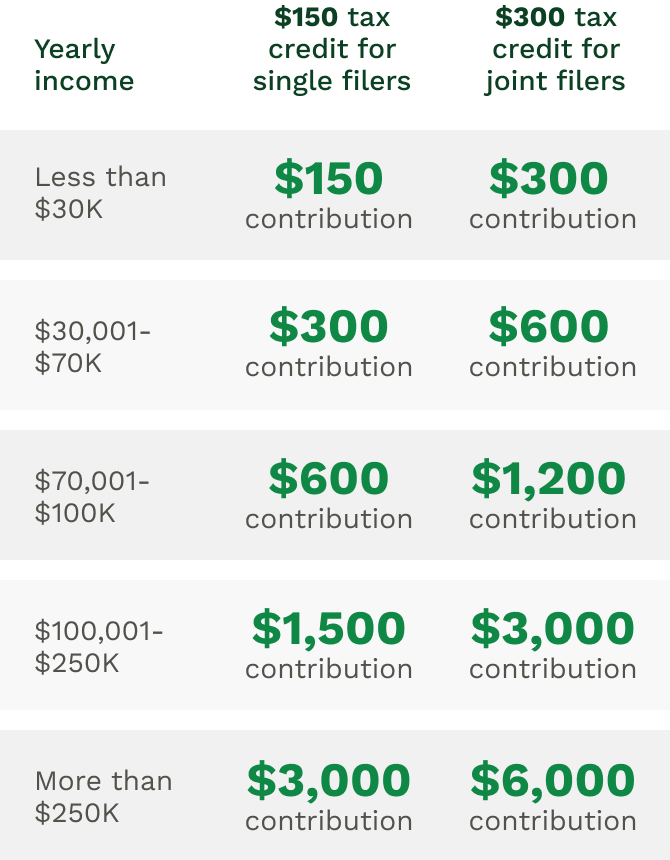

The percentage of contributions eligible for credit varies based on income. For more on the changes to the Oregon plan continue reading OR 529 Part 2 here. Include Schedule OR-529 with your Oregon personal income tax return.

In 2019 individual taxpayers were allowed to deduct up to 2435 for contributions made to the Oregon College Savings Plan while those filing jointly could deduct 4865. K-12 tuition can be treated as a qualified education expense under the federal tax benefit. Percentage of contributions made based on AGI.

Full amount of contribution. Ad Getting a Child to College Can Be Stressful. Out-of-state participants still get the federal tax benefits.

529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and board textbooks or other expenses related to secondary education enrollment. You also get federal income tax benefits as you do not pay income tax on your earnings. 36 rows Tax Deduction.

I have not seen a location to enter my 2020 contributions to the 529 plan. And Oregon residents with out-of-state family members contributing to your childs 529 can take a deduction or credit for those out-of-state contributions on their Oregon taxes. Maximum aggregate plan balance.

Contributions and rollover contributions up to 2435 for a single return and up to 4865 for a joint return are deductible in computing Oregon taxable income. 4 rows Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan. Even though every state has a plan they are not all the same.

Vanguard 529 state tax deduction calculator. Direct Deposit To deposit all or a portion of your refund into an Oregon College Savings Plan or MFS 529 Savings. And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers.

Are 529 contributions tax deductible in oregon. However some states may consider 529 contributions tax deductible. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers.

Two new credits Federal disaster relief 5 Oregon 529 College Savings and ABLE account plans New credit Based on contributions made on or after January 1 2020. Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as well as room and board. Limits on annual 529 state income tax benefits.

Explore the benefits and see how saving for your kids future can help come tax season. All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit. Compound interest adds up.

When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit should be from contributions in the 2020 year and is not a carryforward from 2019 as it specifies. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings plans. State tax benefits may not apply to K-12 tuition.

In the past contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct up to 20000. Check with your 529 plan or your state to find out if youre eligible.

Get Fidelitys Guidance at Every Step. Its up to you to keep records showing the contribution in the event of an audit. You do not need to be the owner of the account to contribute and claim the tax credit.

Never are 529 contributions tax deductible on the federal level. Tax-related changes from 2019 session and federal legislation only. 529 state tax deduction calculator.

Create an Oregon College Savings Plan account. Estimate the state tax deduction or credit you could receive for your 529 contribution this year. Never are 529 contributions tax deductible on the federal level.

10 Things Parents Should Know About College Savings

An Alternative To 529 Plan Superfunding

Does Your State Offer A 529 Plan Contribution Tax Deduction

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Plans Which States Reward College Savers Adviser Investments

Tax Benefits Oregon College Savings Plan

529 Plans Which States Reward College Savers Adviser Investments

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

529 Plans Which States Reward College Savers Adviser Investments

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan State Tax

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

Oversaving In A 529 Is A Much Smaller Problem Than You Would Think R Financialindependence

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog